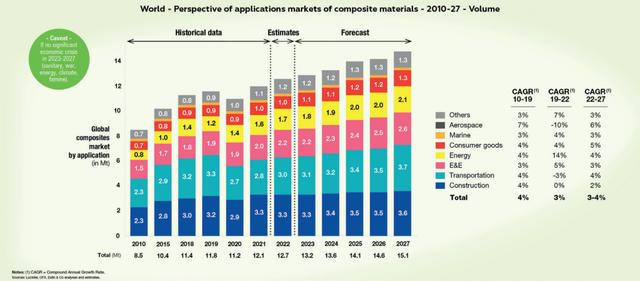

The dynamics of the composites market still depends on the potential economic growth of each country. In terms of composite application markets, stable or even growing demand for electronics will drive the composite industry in Asia, construction in North America and transportation in Europe. This article has been published in JEC Composites Magazine N°150.

In 2020, the Covid-19 pandemic led to a severe downturn that negatively impacted the base industries of composites (aerospace, automotive, construction ......). Following this, the composites industry has been recovering in 2021 and 2022. According to the JEC Observer 2022-2027, recently published and established by Estin & Co for JEC Group, the global market is estimated at 12.7Mt (composites used to produce composite parts) by the end of 2022. It represents a $41 billion market for composites, corresponding to a $105 billion market for components made from composite parts.

Asia still leading, but showing signs of slowing down

Asia should continue to lead with a compound annual growth rate (CAGR) of 4 percent over the next few years, by North America (3 to 4 percent) and Europe (1 to 2 percent). The region is the largest market by volume, accounting for 47% of the global market, and it is also likely to grow faster than other continents, at about 4% CAGR In Asia, the global composites market should climb to 7.3 Mt by 2027, with electrical and electronics (E&E) expected to account for the majority (1.8 Mt).

"Despite the economic slowdown, China should continue to be a strong driver of the global composites industry. For example, the demand for electronics (digitalization, teleworking/learning...) in China and other Asian countries is expected to continue to grow," notes Julien Deleuze, Vice President of Estin & Co.

China is already the world's largest wind energy market, accounting for 48% of the global market. Nevertheless, wind energy will account for less than 8% of China's energy production by 2021.

China is adding about 30GW of new capacity each year, accounting for about half of the new installed capacity. By 2050, the installed capacity could reach 1 TW, accounting for about 26% of the total electricity capacity. [1] Typically, the construction industry in Asia should slow down due to the slowdown in China and its impact on the financial and real estate sectors. The default of the Chinese real estate giant Evergrande in 2021 did not help either. The group that has shaken up China's financial sector has been in the midst of a painful asset sale process since mid-2021. After a strong rise in compound annual growth rate (11%) from 2010 to 2019, the aerospace industry has not fully recovered from the pandemic. Nevertheless, it should maintain a compound annual growth rate of 8% over the next four years. Late last year, China's first indigenously developed narrow-body passenger aircraft, the C919, made its maiden flight and was delivered to China Eastern Airlines in Shanghai, where it is expected to enter commercial operation this spring. The amount of composite materials used reached 11.5% of the weight of the body structure.

Transportation and Construction: A Growth Driver for the North American Composites Market

According to the International Monetary Fund (IMF), the North American economy will grow at a rate of 2% per year in the coming years, and future growth for composites should be about 3% to 4% per year

"North America and China should be strong drivers of the global composites industry. There is still potential for further penetration in the construction sector (major maintenance and development of infrastructure such as bridges, retrofits ......), but there are potential risks in the new construction/equipment segment given the macroeconomic backdrop," Estin & Co. vice president said according to JEC Observer, adding that the region s global composites market (marine, aerospace, consumer products, E&E, energy, construction and transportation) should climb to 4.0 Mt by 2027, with construction and transportation accounting for 1.3 Mt and 1.1 Mt, respectively. Rapidly rising mortgage rates in the U.S. are already putting pressure on home prices across the country. However, the North American construction industry (see column) will remain a major contributor to the composites industry with about 20% of the market, driven by large investment programs in infrastructure construction and renovation (bridges, water networks).

North American aerospace companies were hit hard by the pandemic (-10% CAGR between 2019 and 2022), but seem bound to recover faster than their European counterparts, despite the disruption in the aerospace industry starting before 2020, with a sharp decline in 2019 regarding annual aircraft deliveries due to Boeing 737-MAX difficulties.

Transportation leads the European composites industry

For Europe, financial institutions are forecasting a lower growth rate of 0-1% per year, as observed in the last few years However, EMEA and the Americas together account for 63% of the global composites market in terms of value, which is still very encouraging.

"The dynamics in Europe continue to vary between different European countries, with a difficult overall growth context (access to competitive energy, the war in Ukraine and its consequences ......) . There is a strong focus on transportation and composites can play a role in lightweighting (rail industry, small/light vehicles, hydrogen heavy mobility ......)," explains Julien Deleuze.

In the transport sector, it is worth noting that composites are particularly important for new types of vehicles (hybrid and electric vehicles, for lighter structures to compensate for heavier batteries; hydrogen vehicles, for hydrogen tanks) to improve performance, for example in consumer sporting goods (cycling ......), of which composites account for about 16%.

Construction: a resilient market

The market for composites for construction represents 19% of the global composites market in 2022 in value terms (26% in volume). The industry was hit hard by the Covid-19 pandemic in 2020, but quickly recovered to the structural level. As a result, the construction segment of composites is expected to grow by an average of 2% per year over the next 5 years, if no major crisis occurs during this period. During an economic crisis, infrastructure and renovation or maintenance are more resilient market drivers than new construction.

"Composite projects, while much more expensive, are becoming more competitive as steel, concrete and wood prices rise. In addition, being much lighter in weight and therefore requiring less foundation work makes composite structures more suitable for the environment and reduces the costs associated with labor and plant (machinery) hire for equivalent projects," says a product sales manager who works for a UK group specializing in Estin & Co for the road, rail, marine and coastal sectors interviewed by JEC observers of design and manufacturing services.

The poor health of infrastructure is expected to attract increasing investment in the U.S., which could drive the market. Fiber-reinforced polymer (FRP) reinforcing bars have the potential to replace steel bars and therefore pose a threat to steel products. These products can be replaced by FRP bars because they have a longer service life and will increase the cost of metal processing in the coming years.

There is a lot of work at the European level (February 2007; CNR-DT, 2007) and at the international level (ACI, 2003; CAN/CSA, 2002) on advance recommendations for the use of these bars. The Eurocode is also working on the integration of the use of these reinforcing materials.

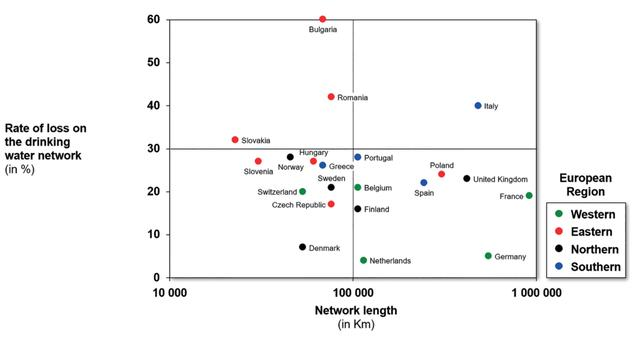

At the European level, water supply networks in Italy and Eastern Europe (Italy, Bulgaria, Romania) offer important opportunities for composite pipe manufacturers in the coming years. The leakage rate in these networks varies from 70.000 km (Bulgaria) to 480.000 km (Italy), varying between 40% (Italy) and 60% (Bulgaria). Therefore, a significant amount of rehabilitation work may be required in the coming years.

References: [1] China Wind Energy Development Roadmap 2050, International Energy Agency (IEA) and Energy Research Institute. https://iea.blob.core.windows.net/assets/8c00f1d3-8054-4e4f-b81f-2b7a23619167/ TechnologyRoadmap-ChinaWindEnergyDevelopmentRoadmap2050.pdf [2] U.S. Steel Rebar Market Size, Share, and Trends Analysis Report by Application (Construction, Infrastructure, Industrial), by Region (Northeast, Midwest, West) and Segment Forecast, 2022-2030.

Xiamen LFT composite plastic Co., Ltd는 LFT&LFRT에 중점을 둔 브랜드 회사입니다. 긴 유리 섬유 시리즈(LGF) 및 긴 탄소 섬유 시리즈(LCF). 회사의 열가소성 LFT는 LFT-G 사출 성형 및 압출에 사용할 수 있으며 LFT-D 성형에도 사용할 수 있습니다. 고객 요구 사항에 따라 길이 5~25mm로 자랑할 수 있습니다. 회사의 장섬유 연속 침투 강화 열가소성 플라스틱은 ISO9001&16949 시스템 인증을 통과했으며 제품은 많은 국가 상표 및 특허를 획득했습니다. 당사의 소재는 고성능 열가소성 특수 엔지니어링 플라스틱이 필요한 자동차, 군사 부품, 화기, 항공 우주, 신 에너지, 의료 장비, 전기 풍력 에너지, 스포츠 장비 및 기타 분야에서 사용할 수 있습니다.